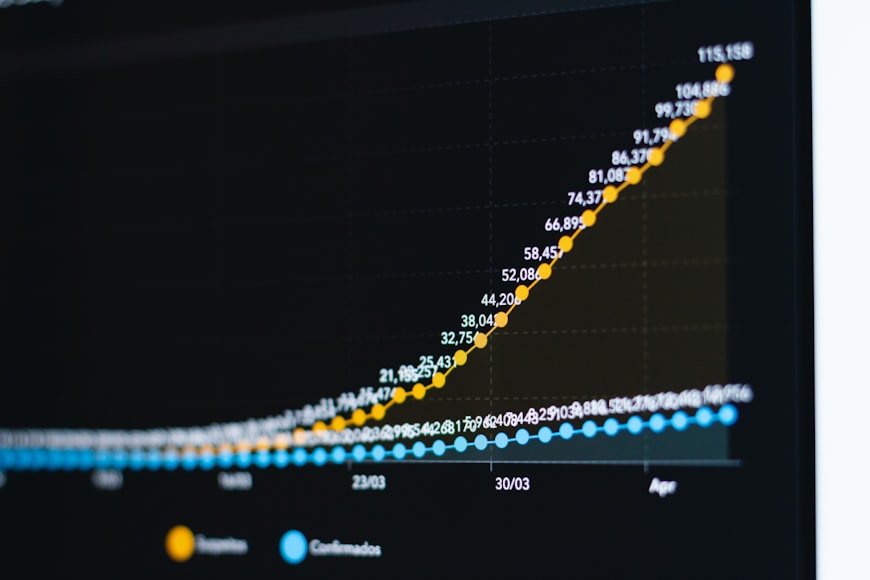

In recent years, especially post-pandemic, a quiet financial revolution has been brewing. Across the U.S., individuals are choosing saving over spending, driven by uncertainty, past regrets, and future goals. This rising phenomenon has a name now: revenge saving.

💡 What Does Revenge Saving Mean?

At its core, revenge saving is a response to hardship. After experiencing financial stress—whether during COVID, job losses, or inflation—many people are taking back control by setting strict limits on spending and prioritizing their savings.

It’s the opposite of “revenge spending,” where people splurged post-lockdown to feel better. Here, the motivation is the same—emotional satisfaction—but the action is the opposite: save more, spend less.

📉 Why It’s Gaining Momentum

In today’s economic climate, the reasons behind this shift are clear:

Prices are climbing, making it harder to live paycheck to paycheck.

Job security feels shaky in many industries.

Student loans and debts are pressing down on younger workers.

And most importantly, people don’t want to be caught off guard again.

So instead of waiting for the next financial hit, many are preparing in advance.

> Personal Finance

> Online Earning

> Investing

> Budgeting

✅ Benefits of Revenge Saving

This approach offers several clear upsides:

You build a safety net faster

It reduces daily financial stress

You’re more in control of your money

Long-term goals like home-buying or retirement feel more realistic

And unlike traditional saving, this comes with emotional motivation—people are saving because they want to feel safe, not just because a blog told them to.

⚠️ Caution: Don’t Overdo It

While saving more is usually a good thing, going to extremes isn’t healthy either.

Cutting every joy from your life—no dining out, no occasional shopping, no short trips—can lead to mental burnout. And financial planning isn’t just about restriction; it’s also about creating a sustainable lifestyle you can enjoy.

If you’re always anxious about spending even $5, it might be time to reassess your balance.

💬 How to Start Revenge Saving the Smart Way

You don’t need to overhaul your entire lifestyle overnight. Here are a few small but smart steps to begin:

- Automate your savings – Have a portion of your income go straight into a savings account.

- Track where your money leaks – Cancel unused subscriptions, avoid impulse buys.

- Set short-term saving goals – Like saving $500 in 30 days. Small wins keep you motivated.

🧭 Final Thoughts

Revenge saving is more than a trend—it’s a reflection of a changing mindset. After years of uncertainty, people are choosing control, stability, and future security over momentary pleasures.

Whether you’re trying to pay off debt, build a cushion, or simply take charge of your finances, embracing this movement might be one of the smartest choices you make in 2025.